What does “Software Development Outsourcing” mean in Latin America?

Recent evidence confirms that the debate around digitalization no longer revolves solely around technology investment, but rather around organizations’ ability to attract, train, and retain IT talent, the true enabler of sustainable execution.

While the corporate world faces a structural shortage of technology talent and rising costs, Latin America is undergoing a profound transformation. The region is no longer perceived as a “support office” and is instead consolidating its position as a relevant player in software development and the global knowledge economy.

This shift is driven by a convergence of factors that position Latin America as a solid alternative to the global shortage of developers, engineers, and digital specialists. Companies in the United States and Europe, pressured by high salaries and intense competition for local talent, find in the region a balance that is difficult to replicate: technical quality, cultural affinity, time zone proximity, and cost efficiency.

The phenomenon goes beyond cost savings. Value no longer lies in the number of hours delivered, but in the intellectual capacity applied to digital products, artificial intelligence, and emerging technologies. Expanding educational ecosystems and a new generation of globally oriented professionals are redefining the software development landscape.

In this context, software development in Latin America moves from being a tactical solution to a strategic decision that impacts innovation, delivery speed, and operational continuity.

The Current State of the Software Industry

According to the NxTide Software Development Rates Report, the software industry faces a structural tension between technological demand and the availability of qualified talent.

In 2020, the world had approximately 26.9 million developers across a global population of 7.8 billion, meaning one developer for every 2,880 people. This ratio is insufficient for today’s level of digitalization.

This gap not only persists, but continues to widen. Over the next decade, a global shortage of 18.2 million professionals in IT roles is projected.

The talent shortage is no longer a human resources issue, but a strategic risk. For many companies, the real cost is not paying more for talent, but being unable to hire it in time and losing market opportunities.

The Rise of Software Development in LATAM

In this scenario, Latin American talent emerges as a strategic response.

Latin America is shifting from being perceived as a source of low cost labor to consolidating itself as a competitive technology hub, with scale, quality, and sustained growth.

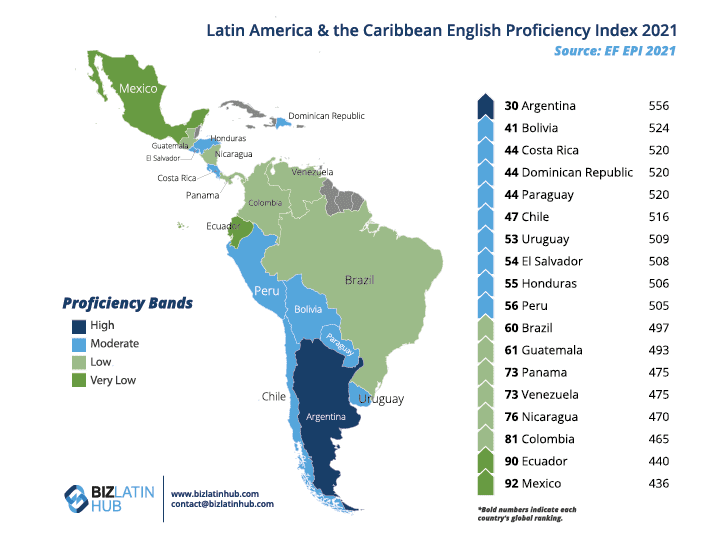

Today, the region has a network of more than 2 million developers, led primarily by Brazil with 750,000 and Mexico with over 500,000. This growth is driven by a strong educational foundation that produces hundreds of thousands of IT graduates annually, who stand out not only for their technical expertise in areas such as DevOps or Data Science, but also for their English proficiency and cultural adaptability. This momentum is supported by government incentive policies and the presence of major international technology companies in the main Latin American capitals.

LATAM and the Talent Competition: India and Eastern Europe

When evaluating global outsourcing strategies, three regions dominate attention: India, Eastern Europe, and Latin America.

India remains the historical leader in volume and cost, although time zone and cultural differences can hinder collaboration in agile models that require constant interaction.

Eastern Europe stands out for its high technical quality and strength in advanced technologies. However, costs tend to be higher, and differences in work styles can impact operational cohesion.

Latin America offers a balanced value proposition: competitive technical talent, sustainable costs, cultural alignment, and time zones compatible with the United States and Spain. For many organizations, this balance is decisive.

Executive Summary

- India: volume and cost, with coordination challenge

- Eastern Europe: high quality, higher costs

- Latin America: balance between quality, integration, and real time collaboration

Latin America as a Strategic Engine for Software Outsourcing

Outsourcing in Latin America combines qualified talent, competitive costs, and time zone and cultural proximity, positioning the region as a key ally in addressing the global shortage of technology professionals.

Competitive costs: Shifting operations from Asia to countries such as Mexico can reduce operating costs by up to 23 percent, while hiring senior developers in Brazil, Mexico, or Colombia represents significant savings compared to the United States, where average salaries exceed 130,000 USD annually.

Cultural proximity: The rise of nearshoring is also driven by the need to reduce geopolitical risk, improve real time coordination, and accelerate decision making.

Talent development: Latin America is making a leap toward Industry 4.0, moving from traditional manufacturing to “mindufacturing”. Today, value lies not only in task execution, but in intellectual capacity applied to software, artificial intelligence, biotechnology, and robotics. Educational ecosystems and technology clusters, such as Nuevo León in Mexico, are producing professionals capable of competing globally and delivering innovation from the region.

Latin American Talent at Its Highest Expression

| Competitive Pillar | Description | Data / Examples |

| High Specialization Talent (“Mindwork”) | Highly specialized professionals in AI, cybersecurity, and robotics, beyond traditional labor. | Brazil, Mexico, Chile as consolidated players. Argentina, Colombia, Uruguay emerging in AI. Knowledge Economy Laws promote the export of high value services. |

| Strategic Financial Arbitrage | Hiring local talent optimizes costs and profitability versus the United States. | Savings of up to 61 percent versus the US. Senior engineer: 132,000 USD in the US vs 31,000 to 45,000 USD in LATAM. Nearshoring reduces operating costs by 23 percent compared to Asia. |

| Full Synchronization and Operational Agility | Geographic proximity and aligned time zones with North America enable real time collaboration. | Facilitates Agile, pair programming, and just in time delivery. Reduced delivery times compared to Asia. |

| Resilience and Scalability | Stable and growing IT market enabling agile expansion. | Double digit growth despite economic crises. By 2026, 70 percent of tech companies expect to increase hiring, and more than 50 percent project growth above 10 percent. |

| Language Specialization and Friendshoring | Politically and culturally reliable region, with bilingual talent adapted to global markets. | Argentina ranks 25th globally in English EPI. Mexico and Colombia offer fluent communication with the US. Costa Rica has strong bilingual talent. Development of Neutral Spanish in AI, such as BPO Alamo in Argentina. |

Country Specific Value and Strategic Enclaves

Latin America has consolidated itself as a strategic ecosystem for global software development, combining highly specialized talent, competitive costs, and environments conducive to innovation. Each country in the region offers unique advantages that make it attractive for technology outsourcing and nearshoring, ranging from established hubs to emerging markets with high growth potential.

| Country | Key Strengths | Technologies / Specialization | Language Proficiency | IT Market Size / Professionals | Additional Competitive Advantages |

| Argentina | Quality over quantity, product mindset, unicorn ecosystem, elite free education | AI, Blockchain, Fintech, SaaS, Cloud, Data Analytics | Leading English proficiency in LATAM | Approximately 150,000 IT professionals | Senior talent, innovation culture, high English level, mature software exports |

| Mexico | Massive talent pool, geographic proximity to the US, trade agreements like USMCA | Enterprise SaaS, Cloud, Embedded, AI, Logistics | High in tech hubs | Approximately 300,000 IT professionals | Competitive costs versus the US, specialized hubs, strong North American connectivity |

| Colombia | Agile startup ecosystem, government support, rapid growth | Web and Mobile Development, Data Analytics, AI, Agile Solutions | Medium to High | Approximately 80,000 IT professionals | Strong execution culture, competitive costs, digital transformation hubs |

| Chile | Economic stability, advanced digitalization, Start Up Chile | AI, Cloud, Data, CleanTech, AgTech, E commerce | Medium to High | Approximately 50,000 IT professionals | Excellent connectivity, product testing before scaling, data center ecosystem |

| Brazil | Large domestic market, venture capital investment, robust ecosystem | Deep Tech, Cybersecurity, Fintech, DevOps, Neobanks | Variable, improving in hubs | More than 750,000 IT professionals | Economies of scale, strong VC investment, high talent concentration |

| Uruguay | Legal security, high per capita software exports, stability | Cloud, AI, Custom Software, GenAI | Medium to High | Approximately 15,000 IT professionals | Tax benefits, highly specialized teams, political and economic trust |

| Peru | Rapid talent growth, emerging IT market | Web, Mobile, Data, Digital Transformation, Fintech | Medium | Approximately 30,000 IT professionals | Growing junior and mid level talent, high growth market, competitive costs |

Leading Solutions and Talent in Latin America

Latin America has consolidated itself as a strategic hub for software development and digital transformation. Beyond talent availability, the region offers end to end capabilities, from design and development to implementation and operation of complex technological solutions.

Artificial intelligence stands out as one of the main growth drivers, with teams building automation, predictive analytics, and large scale personalization solutions for global organizations.

Software development and cloud architectures represent another key pillar. Latin American professionals operate with maturity across platforms such as AWS, Azure, and Google Cloud, designing scalable and resilient environments that optimize costs, accelerate development cycles, and support mission critical operations.

Cybersecurity and data management complete this ecosystem of capabilities. Teams in the region implement protection strategies, access controls, and regulatory compliance aligned with international standards, an increasingly decisive factor in outsourcing decisions.

In addition, the region concentrates talent in full stack development, DevOps, data science, and process automation, enabling flexible and scalable teams tailored to each project’s needs. This allows companies to outsource both specific functions and complete projects through collaborative models and agile methodologies.

This is complemented by a solid base of talent in full-stack development, DevOps, data science, and process automation, enabling flexible outsourcing models ranging from specific functions to full teams integrated into agile methodologies and clear governance frameworks.

Together, these capabilities position Latin America as a global technology partner capable of sustaining complex operations, ensuring continuity, and supporting growth strategies by combining qualified talent, cost efficiency, and cultural and time zone alignment with the world’s leading markets.

Español

Español